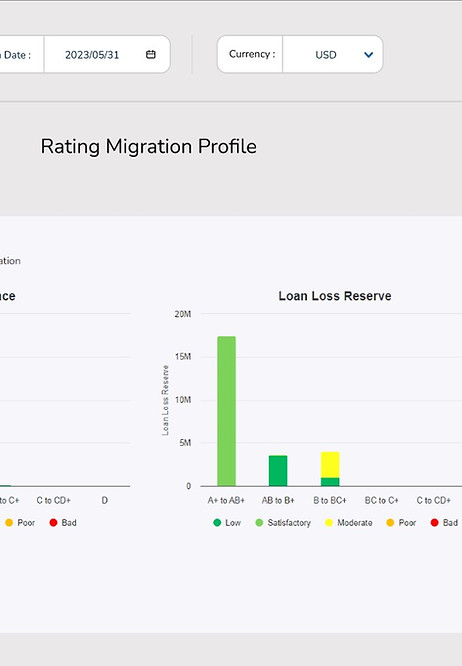

Integrated credit risk management platform that allows you to automate lending operations at scale and monitor and manage lending assets. Financial model and data driven loan risk-based pricing, loan level capital reserve quantification, IFRS9 and CECL compliant loan loss reserve calculations. Comprehensive portfolio level scenario and time series analysis. Consistent loan performance and delinquency analysis. Income and risk adjusted profitability analysis.

Flexible due to easy integration, easy-to-deploy, and powered with data and risk analytics — CreditStudio for commercial and consumer lending is an industry-leading software for financial institutions in emerging markets.

CreditStudio

Data Driven Risk Management Solutions

Why Choose CreditStudio?

Key Benefits

Achieve top performance for all loan products and customer segments.

Credit-Risk Manager©

Research & Financial Model

Key Performance Indicators

Portfolio Management

Risk-Based Loan Pricing

Capital Management

Regulatory Reporting & Compliance

Credit Scoring

Models

Features of CreditStudio

Personalized

Experience

Ability to drill down and up to analyze your data through different perspectives to extract valuable insights from it to make timely credit risk decisions. Able to download reports on the go.

Ability to Integrated from Different Systems

CreditStudio can be easily integrated with centralized and cloud databases such as Oracle's Flexcube and Azure Cloud Services.

To Request for More Information Please Fill the Form